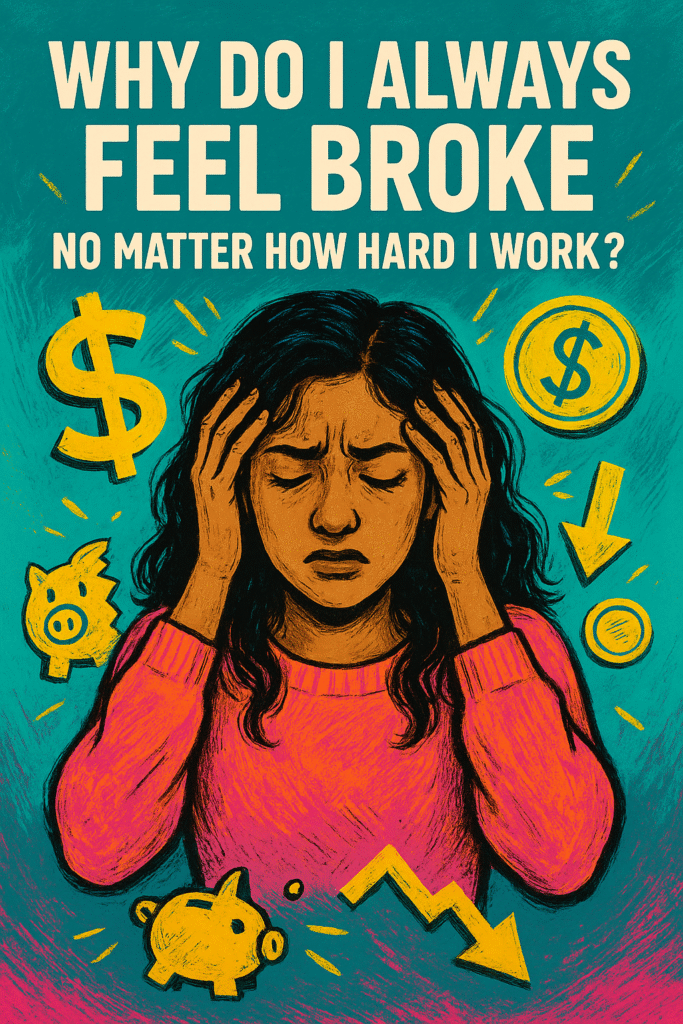

Ever feel like you’re doing everything right, yet your bank account says otherwise? You budget, you hustle, you try to save — but somehow, you still feel anxious every time rent is due.

If that sounds like you, you’re not alone. And no, it’s not just about income. It’s about identity.

Why solving this problem matters

You’re working hard. You’re doing what they told you: get the job, don’t overspend, hustle more. So why does it still feel like money slips through your fingers?

The truth most finance blogs miss is this: feeling broke is often a symptom of deeper beliefs rooted in your subconscious mind.

You may have grown up hearing phrases like:

- “Money doesn’t grow on trees.”

- “Rich people are greedy.”

- “We can’t afford that.”

These messages didn’t just pass through you. They programmed you. Your internal system may still be operating on scarcity, even while you’re consciously chasing abundance.

The hidden blocks behind why you still feel broke

Your subconscious is still in survival mode

Even if your income has grown, if your subconscious still believes there’s never enough, your nervous system will feel unsafe. You might spend impulsively or hoard money out of fear. Either way, the stress stays.

You’re stuck in a scarcity identity

If deep down you see yourself as the broke one, you’ll unconsciously sabotage financial growth. You may undercharge, under-earn, or downplay your success — just to stay in the discomfort that feels familiar.

You equate worth with struggle

Maybe you believe that working harder means deserving more. So when money comes easily, you feel guilty receiving it. This belief quietly keeps abundance out of reach because it links ease with shame.

The practical path to rewiring your money mindset

Get honest about your money beliefs

Write down every belief about money you can remember hearing — from family, culture, school. Then ask yourself: is this belief really mine? Is it helping or harming me?

Build new beliefs that feel emotionally safe

Try affirmations that create a sense of stability. Examples:

- “I am safe receiving more than enough.”

- “Money flows to me with ease and integrity.”

Say them daily with emotion. Record them in your own voice and listen before bed. Repetition creates rewiring.

Start acting from abundance, even in small ways

Wear clothes that make you feel confident. Tip generously. Save a small amount with gratitude. These micro-actions send a message to your nervous system: we are safe now.

You’re not lazy. You’re not doomed. You’re simply overdue for a mindset upgrade — and you deserve a money story that actually supports you.

If you’re ready to explore how your emotions and mindset influence your financial decisions on a deeper level, Mind Money Balance offers therapist-backed insights into rewiring limiting money beliefs and developing financial self-trust.

Take the first step: Start noticing your patterns

You don’t need a perfect plan or a financial degree to shift your money mindset. What you need is awareness. Over the next 7 days, notice when you feel guilt around spending or fear around saving — and write it down.

That one simple habit can create more change than any budget ever could. Real transformation starts when you stop ignoring what you feel, and start exploring it with curiosity instead of shame.

Common questions

| Question | Answer |

|---|---|

| Why do I feel broke even with a good job? | Subconscious beliefs about scarcity can make even high earners feel unsafe financially. It’s not just about income — it’s about internal programming. |

| Can I really change my money beliefs? | Yes. With consistent awareness, repetition, and emotional safety, the subconscious mind can be rewired over time. |

| How long does it take to feel different? | Many people feel emotional shifts within weeks of daily practice. Deeper changes take time but build real financial confidence. |